Established as a series of dialogues between leading experts in private wealth and sustainability from across the globe, the primary purpose of the week was to explore what the implications of the responses to the pandemic situation may hold for climate action, and what steps could be taken with private capital to align the immediate response to the sustainability imperative.

Involving more than 100 investment managers, and 1,000 individuals from across 27 countries, the event sought to explore the central issue of the role that private capital will play in financing sustainability post Covid-19.

Several themes emerged.

- The common agreement that the legacy of the crisis had to be about the need for a new order in the economy and society and not simply the restoration of an old normal.

- The relationship between public capital and private capital will change and that it is vital that there is a meaningful role for private capital here in the years ahead.

- A more holistic appreciation of the notion of systemic risk and a much more enticing set of incentives to think about the longer-term before the short-term.

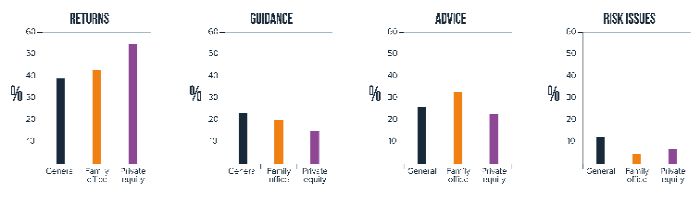

The key result identified for the public was that whilst managing the recovery post Covid-19 in a sustainable manner, there will be a continuing need to develop products and services to draw in private capital. Participants in the week were canvassed on the most important factors that would drive private capital into sustainable investments.

Most important factors driving private capital

Returns

Whilst the evidence so far on ESG related returns is positive, with research showing that sustainable investing returns tend to hold out better in a downturn, returns continue to be a key concern for private capital investors. While there is some motivation for societal good, sustainable financing is not philanthropy. When polled, 55% of sustainable finance week attendees still put "returns every time" as the most important factor in attracting private capital into sustainable and green investments.

Adjusted returns

When investing sustainably, returns should not be considered in a silo as risks and returns are intrinsically linked, especially in sustainable finance. When polled, only 12% of attendees saw risk issues as a key driver which could highlight the lack of urgency in considering the systemic risks of climate change. The resilience of investments will continue to move to the forefront of conversations, particularly seeing the effects of Covid-19. For sustainable investing it can be too simplistic to discuss straight returns, and instead consideration should also be around qualitative, quantitative, and risk adjusted returns.

Impact, not ESG

Private sector investors are increasingly concerned with the impact of their investments and the companies they are investing in. This is largely driven by a generational handover of wealth from 'boomers' to 'millennials', and Covid-19 highlighting to investors the positive societal impact they can have through their investing. To this end, impact needs to be measurable. Advisers will have to report investment impact to their clients in an understandable and useful format. Working out the best method for measuring impact and reporting is still a work in progress for advisers and sustainable finance professionals.

There is a clear concern that regulatory requirements can become burdensome with a focus on in checklists and box ticking exercises. Principle-led initiatives (such as the Guernsey Private Equity Principles) can be more useful tools to provide the flexible guidance for owners of private capital

Patient investors

Private equity and UNHW family offices have always had access to more patient capital. Historically this patience and longer-term planning has been evident in this space through life science investments, but now there is a growing opportunity for private equity and family offices to directly invest in sustainability and be able to wait for long term investments to come through. Products and advisers will need to reflect this through having a long-term view and viable long-term strategy. Private equity may need to consider the availability of longer-term vehicles, rather than the traditional 10-year cycle, to match the potentially the term of the investments.

Collaboration

Co-investing for family offices could be a growth area, with collaboration between smaller or single-family offices enabling private wealth to align to private equity and access greater pools of funds to increase the impact of their investing. This trend has been seen already in Guernsey on a smaller scale with some interaction between family offices.

This collaboration and co-investing will also enable a knowledge transfer. Talent within the sustainable space is still growing and there is a demand to be met for knowledgeable advisers on sustainability. This talent base will be integral in the supporting the wider education, demystification and consolidation of all the different terms, initiatives and future regulatory changes.

Conclusion

Sustainable finance week showed some of the steps that can be taken both during and post the pandemic to jointly respond to Covid-19 whilst still not letting the crucial task of mitigating climate change fall to the wayside. Public and private capital must be able to jointly work together to develop the pathway for financing sustainability. As a leading centre of private wealth and sustainable finance, Guernsey is well placed with green finance initiatives, such as Guernsey's Green Fund regime, to meet climate change goals by routing global private capital to the cause of sustainability.

Originally published July 14, 2020.

For more information about Guernsey's finance industry please visit www.weareguernsey.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.