The Ministry of Finance (Department of Revenue) has released a notification dated March 08, 2021 mandating GST Electronic Invoicing System for taxable Suppliers with turnover more than INR 50 Crores[1]. The present notification has been issued further amending the Ministry's notification March 21, 2020 which made GST E-invoicing mandatory for suppliers with turnover more than INR 100 Crores[2].

Thus, the GST E-invoicing has been made mandatory by the Government for suppliers having aggregate turnover exceeding from earlier stipulated amount of INR 100 Crores to INR 50 crores. The same shall be effective from April 1, 2021.

As per the amendment, the notified class of registered persons have to prepare invoice by uploading specified particulars of invoice (in FORM GST INV-01) on Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN).

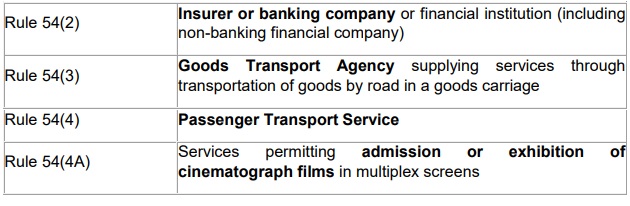

Any registered person other than those referred in following rules whose:

The eligible tax suppliers can practice E-invoicing only after an Invoice Reference Number (IRN) has been procured by them. The same can be obtained by filling out all relevant information and details as required in FORM GST-INV-01, available on Common Goods and Services Tax Portal at www.gst.gov.in.

EXCEPTIONS FOR TAXABLE SUPPLIERS

The abovementioned notifications shall be applicable to all taxable suppliers except from:

Conclusion

Allegedly many businesses have been engaging in tax evasions, tax leakages and other tax related frauds since decades. Owing to ever-increasing frauds, the practice of E-invoicing is being promoted by Ministries across the world. One-time reporting of invoices provides real-time access to both, the Authorities as well as the buyers may combat the malafide practices of tax evasion in India.

To enhance the purview, the Government of India vide this notification has reduced the requisite turnover from INR 100 crores to INR 50 crores. This legislative change shall enable additional thousands of firms and suppliers to practice E-invoicing, thereby eventually benefitting both, the business and the customers.

Footnotes

1 https://www.cbic.gov.in/resources//htdocs-cbec/gst/notfctn-05-central-tax-english-2021.pdf

For further information please contact at S.S Rana & Co. email: info@ssrana.in or call at (+91- 11 4012 3000). Our website can be accessed at www.ssrana.in

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.