Whether you are a company manager, a foreign entrepreneur, or an investor, sooner or later you might face an issue of debt collection in Poland. You might find yourself either as a creditor intending to quickly recover what is owed or a debtor intending to control liquidity or debt collection expenses. Below we present the most common questions and answers concerning debt collection in Poland.

Types of debt collection in Poland

There are two types of debt collection in Poland:

- amicable (extrajudicial) and

- judicial debt collection.

These processes are different, but they also share certain common features. Creditors wanting to recover an outstanding payment should remember that in many cases they may need to use the amicable method of debt collection before seeking a court's intervention. Debt collection procedure in Poland can be initiated against natural persons and legal persons, such as companies and partnerships, as well as associations, foundations, sports clubs and other entities operation in the market.

How debt collection works in Poland?

Debt collection works similarly as in any other jurisdiction. Claims may be recovered via amicable methods by the collection lawyers or be pursued in the court in regular litigation or in fast-track injunction procedures. Debtor will be charged with late payment interest and debt recovery expenses.

How to start - debt collection process?

Before executing any transaction or making any decision on initiating court proceedings against a debtor in Poland, a creditor should first research of the debtor's financial situation and assets.

Debtor due diligence in Poland differs depending on whether the debtor is:

- a commercial company (and/or partnership) or

- a natural person - a consumer, a sole proprietor.

Corporate debtor verification in Poland

In the case of commercial companies which are required to submit annual financial statements, the research of the financial situation can be made based on the reporting documentation uploaded to the open-access government search engine available at eKRS.

Using this tool, you can access the financial statements and performance reports for previous years. These documents will give you a picture of the potential partner's or debtor's financial situation. Provided you know how to read financial statements, they can tell you if a company has any valuable assets, what is the value of its liabilities and what were its profits over the recent years. Failure to draw up these documents by a company despite being required to do so can be a major red flag for a creditor.

Another portal where details about a company available in the database of the National Court Register can be downloaded (EMS) can be a useful source of information about a debtor. Section 4 of the company's record may contain information about outstanding taxes, payments to the Social Insurance Institution (ZUS) or other creditors and may tell you if the debtor's assets were frozen as a result of bankruptcy or restructuring proceedings relating to the debtor. This information can be accessed by anybody for free.

Individual debtor verification in Poland

Researching the financial and assets situation of a natural person, including one running a sole proprietorship, is more challenging, because they are not required to disclose information about their affairs in any publicly available portal. There is one source that maybe helpful - the National Debtors Register. This portal will tell you if any proceedings, e.g., restructuring or bankruptcy proceedings, have ever been held with respect to a potential business partner or a debtor or if they have ever been disqualified from running a business. Thanks to this portal you can also learn information about partners in partnerships who are liable for the partnership's debts without limitation with all their assets. All this information can prove extremely helpful in verifying the financial situation and credibility of potential business partners and debtors alike.

You should also remember about other, less official tools to research the debtor's financial situation in Poland. These include:

- Online research,

- Credit Reference Agency,

- National Debts Register,

- Detective services,

- Requesting information from courts with jurisdiction over a debtor's seat or address on whether bankruptcy or restructuring proceedings are pending with respect to the debtor or researching a debtor under enforcement proceedings.

Do I have to send a demand for payment to the debtor?

The first and essential element that opens the extrajudicial stage of debt collection is sending a notice of default to the debtor.

The role of the demand for payment in extrajudicial debt collection is essential for two reasons:

- First of all, it shows the debtor that the creditor takes the required steps to recover the payments owed and can serve as an incentive to either pay the debt or start out-of-court negotiations.

- Second of all, if the creditor takes the matter to court, the notice of default is a proof that they attempted to solve the dispute amicably and indicates the date when the claim became due and payable (in the case of debts with unspecified payment dates).

A debtor's responds to the notice in which they, for instance, offer to pay the debt in instalments, but do not challenge its existence, is strong evidence that the debtor admitted the claim. This, in turn, is crucial in determining that the limitation period on the claim has been interrupted and can facilitate the creditor to obtain an order for payment without undue delay.

Out of court settlement with debtor

If the creditor decides to reach an agreement with the debtor over the payment of a debt, they may enter into a so-called out-of-court settlement whereby the parties agree the terms of payment based on mutual concessions. The most common solutions include:

- payment in instalments,

- postponement of the payment date,

- giving up a portion of interest by the creditor, etc.

You should remember that an out-of-court settlement, although legally binding, cannot serve as grounds for debt enforcement in the course of a procedure held by a debt enforcement officer. If the debtor defaults on the settlement, the creditor still has to file a court action. For this reason, if you are about to execute an out-of-court settlement, you should consider using appropriate security arrangements, such as a blank promissory note, a suretyship provided by a third part or the debtor's submission to enforcement in a notarial act limited to the amount specified in the settlement. With any of these in place, your chances of recovering money in the case where the debtor becomes insolvent or defaults on due payments are much higher.

Debt Collection Law Firm or Agency

In the event that the debtor refused to pay or ignored the notice of default, you can always turn to a debt collection agency or a law firm specializing in debt recovery. However, bear in mind that these agencies and firms take a percentage of the debt they help recover and are not authorized to seize a debtor's assets or bank accounts (these powers are available to debt enforcement officers only). Their services principally involve reminding the debtor about the overdue payments by calling him and sending official letters.

Selling overdue debt

One of increasingly popular solutions is the assignment of a debt on a debt exchange. This way the creditor can sell a debt and recover at least a portion of the money owed to them.

Are there public debt registers in Poland?

Yes - can list your debtor in the National Debts Register of Poland. Once a debtor in entered in the register, they lose all financial credibility among business partners and financial institutions. This can prove a strong incentive for the debtor to pay what they owe as soon as possible. In many cases letting the debtor know that you intend to report their details to the National Debts Register will be enough to convince them to pay their debt. Only businesses are entitled to report a debtor's details to the register. If the debtor is not a consumer, the total amount of back payments owed to the creditor must be higher than PLN 500 and they must be overdue for at least 30 days (in the case of a consumer the minimum requirements for debt in PLN 200). Before reporting a debtor's details to the register, you must always send a notice of default to the debtor first and you must be able to prove that you did.

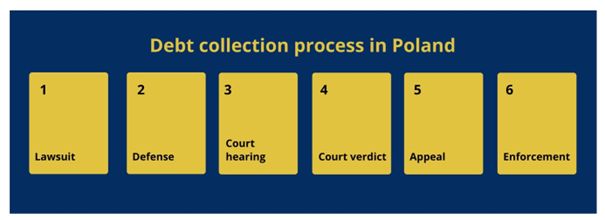

How to pursue a debt collection case in the court?

If the extrajudicial debt collection methods fail, the creditor can pursue their claims in the court of law. Debt collection - litigation is an element of the Polish civil procedure. Debt collection - litigation involves two opposing parties:

- the claimant, namely the party who seeks from the court a specific determination indicated in the pleading initiating the proceedings - the statement of claim - and

- the defendant, namely the party who requests the court to dismiss the claimant's claim (dismissal of the action).

If the creditor decides to lodge their claims in court, they must be prepared to pay a court fee for starting their court case. The amount of the court fee in payment actions depends on the value in controversy.

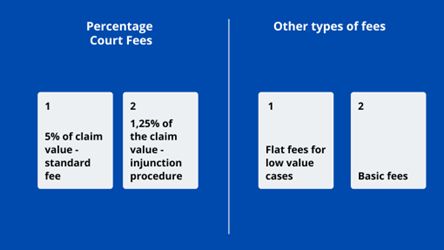

What are the court fees for debt collection?

There are three types of court fees:

- fixed fees,

- basic fees, and

- percentage fees.

In majority of cases the court fee shall be of 5% of the value in controversy. The court fee shall be paid in advance, prior to launch of the collection court case. Upon wining the court fee is fully reimbursable from the losing party.

Can I file a lawsuit to collect a debt?

In order to claim a debt in court, you need to prepare a lawsuit. A lawsuit is a document initiating litigation and it must satisfy certain conditions. A copy of a correctly drafted lawsuit shall be provided to the opposing party and the legal proceedings can begin. Just like any other pleading, a lawsuit (statement of claim) must specify the details of the court to which the document is submitted, details and addresses of the parties and their attorneys (if any) and the type of the pleading.

Moreover, a statement of claim should also set out with precision the remedy sought by the claimant, that is what are their requests that the court should award in the final ruling. Apart from payment of overdue amounts from the defendant, in the statement of claim the claimant may seek the award of late-payment interest accrued from a specific date or the award of costs of litigating the case. The statement of claim can also set out the evidence that the court should take. This part opens the statement of claim and is referred to as the particular of claim.

The request for remedy should be accompanied by reasons explaining why the relief should be awarded, so that the court can decide if there is merit in the claimant's claims. To that end, in the causes of action section of the document the claimant should set out the facts that justify their claims (e.g. the litigants executed a sale contract on a specific date, the claimant handed over the purchased item to the buyer, but the buyer failed to pay). In the statement of claim, the claimant should also provide evidence to demonstrate that their claims (requests for relief) are justified. In simple actions for payment, it is usually sufficient to provide copies of invoices, bills, documents confirming that the claimant kept their end of the transaction (e.g. proof of delivering the purchased item, wire transfer confirmation, etc.) with the statement of claim. If the circumstances of the case are more complex and the claimant expects the defendant to challenge the existence of the claim or its value, the claimant may want to consider applying to the court (in the statement of claim) to admit and take evidence from witnesses to support the alleged facts. In some cases, proving the value of the claim asserted by the claimant may require expert evidence, that is an opinion issued by an expert in a given filed. An expert's opinion may be necessary, for instance, when the claimant wants to prove that they suffered losses of specific value in consequence of inappropriate performance of a contract by the defendant.

What is the late payment interest for overdue claims in Poland?

In Poland, statutory interest is regulated by the Act of August 29, 1997 - Banking Law. Recently statutory interest for delay is as much as 12.25% from August 2022. In July 2022 it was 12%, and in March 2022 - 9%.

Does debt collection case always involve a hearing in court?

Sometimes the court ends the case with an order for payment without the participation of the parties and sometimes court decides that the case should go to trial. During the trial, the parties provide statements to the court in respect of individual facts of the case, the court admits and takes evidence (e.g. from witnesses) and interrogates the litigants. In principle, the court's goal is to close of the case during the first hearing, however, in many cases a trial is spread over several hearings, especially where the litigants applied to take evidence from witnesses. The case in court ends with a verdict.

How enforcement of judgement works in Poland?

The enforcement procedure in Poland is held by a specialized public official called a public bailiff. The debt enforcement takes place upon an application filed by the creditor. The process must be accompanied by the relevant enforcement order. This is nothing more than a court decision that is final. Once such a judgment has become final, the creditor may apply for an enforcement clause, i.e. for an enforceable title. The application for an enforcement clause is submitted to the court, which, in the clause procedure, determines whether the judgment is final and enforceable by way of compulsion and then grants the enforcement clause in question. The next step is to draw up an enforcement application and submit it to the bailiff. In the request, it is mandatory to indicate from which assets of the debtor we want the enforcement proceedings to be conducted. Enforcement may be carried out from:

- the debtor's bank accounts,

- movables belonging to the debtor,

- remuneration for work,

- pensions or annuities paid monthly to the debtor by the Social Insurance Institution,

- tax overpayment, which the tax office will not return to the debtor but will pass it on to the bailiff,

- property rights, such as the right to divide or distribute property,

- debtor's claims against a third party,

- real estate owned by the debtor,

- other assets from which it will be possible to obtain sums to satisfy the creditor.

Search for debtor assets

If we do not have knowledge of the debtor's assets, bank accounts held by the debtor, receivables, we do not know whether the debtor is working or receiving Social Security benefits, then we may commission a public bailiff to search for the debtor's assets for remuneration. The bailiff, after we have received an advance for the costs he or she will have to incur, will take action himself or herself and establish the debtor's assets. Such a procedure may lead to a quicker and more efficient conclusion of the enforcement proceedings.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.