Amending delegated acts ("Delegated Acts") under the UCITS Directive and the Alternative Investment Fund Managers Directive ("AIFMD") are due to apply from 1 August 2022.1

The delegated acts are designed to complement the requirements set out in the Sustainable Finance Disclosure Regulation ("SFDR") and the Taxonomy Regulation and seek to integrate sustainability risks and considerations into the UCITS and AIFMD frameworks. Fund managers will be required to:

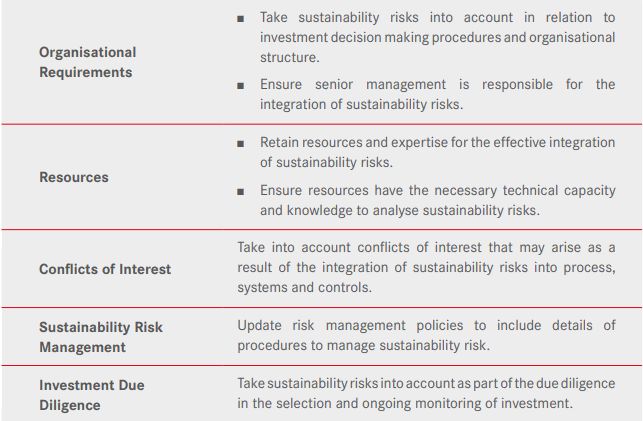

- integrate sustainability risks and take into account sustainability factors in the management of their funds, including organisational procedures and resourcing;

- consider potential conflicts of interest arising as a result of that integration;

- take sustainability risks into account as part of the due diligence in the selection and ongoing monitoring of investment; and

- update risk management policies to include details of procedures to manage sustainability risk.

A "sustainability risk" is defined in the SFDR as "an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment." "Sustainability factors" are defined as "any environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters". AIFMs, UCITS management companies and self-managed UCITS will need to take into account sustainability factors as part of their duties towards investors.

The key requirements under the Delegated Acts are set in the table below.

MiFID Changes – Sustainability Preferences

In a related development, an amending delegated act under MiFID II, which applies from 2 August 2022, will mean that investment firms providing financial advice or portfolio management will have to obtain information about their clients' sustainability preferences as part of the suitability assessment. As a result of these amendments, the European Securities and Markets Authority ("ESMA") launched a consultation on changes to its guidelines on certain aspects of the MiFID II suitability requirements, which closed on 27 April 2022. ESMA expects to publish a final report on the final guidelines in Q3 2022, unfortunately after the application date of the delegated act. These changes may significantly impact distribution, as distributors will, in the first instance, only be able to offer products investing in sustainable investments, products with Taxonomy-aligned investments, or products which consider principal adverse impacts, to meet an investor's sustainability preferences.

Footnote

1 Commission Delegated Directive (EU) 2021/1270 and Commission Delegated Regulation (EU) 2021/125

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.