Amending delegated acts ("Delegated

Acts") under the UCITS Directive and the Alternative

Investment

Fund Managers Directive ("AIFMD") are

due to apply from 1 August 2022.1

The delegated acts are designed to complement the requirements

set out in the Sustainable Finance

Disclosure Regulation ("SFDR") and the

Taxonomy Regulation and seek to integrate sustainability

risks

and considerations into the UCITS and AIFMD frameworks. Fund

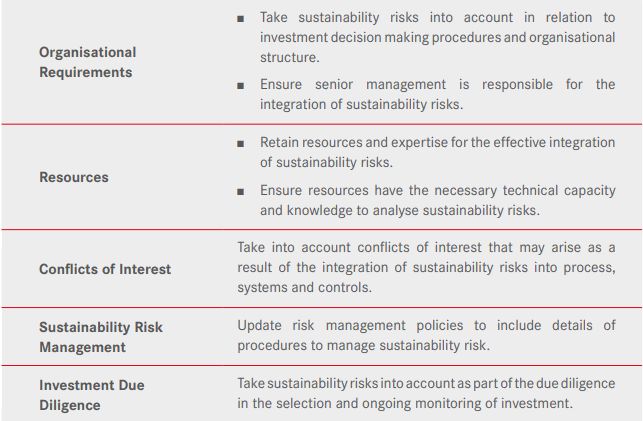

managers will be required to:

- integrate sustainability risks and take into account

sustainability factors in the management of their

funds, including organisational procedures and resourcing; - consider potential conflicts of interest arising as a result of that integration;

- take sustainability risks into account as part of the due

diligence in the selection and ongoing

monitoring of investment; and - update risk management policies to include details of procedures to manage sustainability risk.

A "sustainability risk" is defined in the SFDR as

"an environmental, social or governance event or

condition

that, if it occurs, could cause an actual or a potential

material negative impact on the value of the

investment."

"Sustainability factors" are defined as "any

environmental, social and employee matters, respect for

human

rights, anti-corruption and anti-bribery matters".

AIFMs, UCITS management companies and self-managed

UCITS will need to take into account sustainability factors as part

of their duties towards investors.

The key requirements under the Delegated Acts are set in the table below.

MiFID Changes – Sustainability Preferences

In a related development, an amending delegated act under MiFID

II, which applies from 2 August 2022,

will mean that investment firms providing financial advice or

portfolio management will have to obtain

information about their clients' sustainability preferences as

part of the suitability assessment. As a result

of these amendments, the European Securities and Markets Authority

("ESMA") launched a consultation

on changes to its guidelines on certain aspects of the MiFID II

suitability requirements, which closed on

27 April 2022. ESMA expects to publish a final report on the final

guidelines in Q3 2022, unfortunately

after the application date of the delegated act. These changes may

significantly impact distribution, as

distributors will, in the first instance, only be able to offer

products investing in sustainable investments,

products with Taxonomy-aligned investments, or products which

consider principal adverse impacts, to

meet an investor's sustainability preferences.

Footnote

1 Commission Delegated Directive (EU) 2021/1270 and Commission Delegated Regulation (EU) 2021/1255

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.