Budget as a central policy document of government will show how government will prioritise and achieve its annual and multi-annual objectives. Apart from financing new and existing programmes, the budget is the primary instrument for implementing fiscal policy and thereby influencing the economy as a whole (OECD 2014). It is no longer a news that the 2023 budget proposal of ₦21 trillion (US$48 billion), the largest in the history of Nigeria, is before the National Assembly. Once approval is granted by the National Assembly and the President gives his assent to it, it becomes a fiscal tool with which both 2023 recurring and capital expenditures of government will be monitored and controlled. Given this background and the infrastructure gap of US$2.3 trillion, it is important we examine the adequacy of the proposed 2023 capital expenditure of ₦5.53 trillion (US$13 billion) in the face of seemingly debt crisis and dwindling revenue generation capacity of government.

A core principle of budgetary governance is that the capital budgeting framework should be designed to meet national development needs in a cost-effective and coherent manner. This principle recognises that capital investment plan by its nature has impact beyond annual budget. Hence, in establishing capital investment plan, considerations should be given to objective appraisal of economic capacity gaps, infrastructural development needs and sectoral/social priorities. If this principle must hold, It is therefore imperative to mention that the 2023 budget estimate may make it difficult for the country to achieve, boost and modernize its stock of infrastructure by the end of 2043 as projected by the revised National Integrated Infrastructure Master Plan (2020-2043) .

The National Integrated Infrastructure Master Plan

The National Integrated Infrastructure Master Plan (NIIMP) is the government's strategic document that provides guidance on infrastructure investment in Nigeria, including the plan to boost the country's economy through massive investment in infrastructure development through private sector participation. The plan was initially developed in 2012 and approved in 2014, but was reviewed in 2020 by the Federal Ministry of Finance, Budget and National Planning. The revised NIIMP sets out the goal of raising Nigeria's infrastructure stock to at least 70% by the year 2043.

US$2.3 trillion is the total infrastructure investment required for the 23-year period (2020-2043) to raise the infrastructure stock to 70% by 2043. Out of the total infrastructure investment required, US$150 billion is needed annually (by both the private (US$84 billion) and public (US$66 billion) sectors) to finance infrastructure development over the medium-term period of 2021- 20251 .

Over the 23-year period, the share of the private sector in total investment requirement is estimated at c.56% while the public sector (Federal and States) accounts for the remaining c.44%.

Table 1: Classes of Infrastructure Assets and Investment Requirements

Source: National Integrated Infrastructure Master Plan and Andersen Analysis

The largest investment needs are in the energy and transport sectors both of which represent more than 50% of the required infrastructure investments over the plan period. Investment in these sectors should be accorded the highest priority, since they will provide a solid stock of supporting infrastructure in place for other sectors such as Water, Agriculture, and Mining, laying a foundation for subsequent growth in these sub-sectors.

Capital Expenditure Budget and Annual Infrastructure Investment Requirement by Public Sector

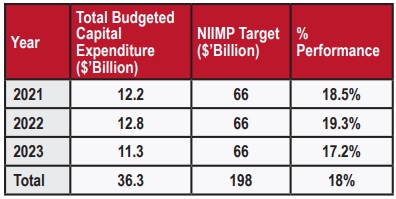

It is obvious that the country has not been able to meet its annual investment target of US$150 billion from both budgetary provision and private sector funding. As shown in Table 2 below, the average annual budgetary allocation for capital expenditure has been 18% of targeted infrastructure investment since 2020 due to fiscal imbalance, impact of COVID-19 pandemic and the "Russia-Ukraine" war, which has resulted in global supply chain disruption and energy crisis. All of these shocks may have contributed to slow economic growth and escalating debt service leading to inadequate revenue to fund government aspirations.

Table 2: Analysis of Capital Expenditure Budget and NIIMP Public Sector Target

Source: Budget Office of the Federation and Andersen Analysis

For the government to meets its annual infrastructure investment target over the short-medium term period of 2021- 2025, it will require a cumulative budgetary provision of US$294 billion2 between 2024 and 2025 for capital expenditure. This is a real tall order as the 2023 budget estimate, Nigeria's largest budget themed the "Budget of Fiscal Sustainability and Transition", is only about US$48 billion. Perhaps, a supplementary budget may be required in the course of 2023.

Capital Expenditure Budget Performance

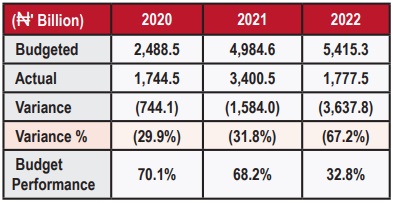

While government has also carefully considered its revenue generation and borrowing capacity in estimating its budgetary provisions, budget performance has also declined over the years which resulted to slower economic growth in the long term. Our analysis of capital budget (2020-2022) as shown in Table 3 revealed the following:

- The average budget performance of the capital expenditure over the period under review was 62.3%.

- The budget performance for 2021 actual capital expenditure compared to the pro rata actual performance figure (Jan-Nov) is 74.4% and 49.2% for 2022 (Jan-Aug).

- The actual expenditure over the review period is below budgeted capital expenditure which indicates that the government is unable to meet its expectation to finance capital investment. This can limit the productivity of the economy as infrastructure is pivotal in boosting the economy.

- The budget performance also declined over the review period which can translate to slower economic growth in the long term.

Table 3: Analysis of Capital Expenditure Budget Performance

Source: Budget Office of the Federation, CBN Public Finance Statistics and Andersen Analysis

"In our view, the country requires implementable initiatives and policies that will unlock private capital and investment for infrastructure developments in the face of dwindling revenue and debt crisis. Countries such as India, Australia and the United Kingdom were able to deepen their infrastructure developments through private sector funding. To be able to attract private sector funding and also build investors' confidence, the government should have clear actions and implement them."

Conclusion

The country currently spends less than 1% of its annual Gross Domestic Product (GDP) on infrastructure as against the required levels of between 3% - 5% of annual GDP. The Nigerian infrastructure stock is currently 25% of GDP, which is significantly lower than South Africa of 87% and international benchmark of 70% for other emerging economies.

In our view, the country requires implementable initiatives and policies that will unlock private capital and investment for infrastructure developments in the face of dwindling revenue and debt crisis. Countries such as India, Australia and the United Kingdom were able to deepen their infrastructure developments through private sector funding. To be able to attract private sector funding and also build investors' confidence, the government should have clear actions and implement them along the following lines:

- Develop an Economic Stabilization and Recovery Strategy (ESRS), which will include the formulation of policies that target/reduce insecurity and insurgence, reduce cost of governance, reduce inflation, stabilize the exchange rate, optimize revenue generation, ensure debt sustainability, enhance exports and local content;

- Increase budgetary allocation for infrastructure with NIIMP indicators as key targets;

- Unlock private sector financing and investment to accelerate physical and social infrastructure development across the different sectors. For instance, the India projection of becoming a US$5 trillion economy by 2024-25 is premised on private investment into physical and social infrastructure. Hence, it is now very important that the Infrastructure Corporation (InfraCorp) is properly supported to realise its strategic objective of mobilizing the needed infrastructure funding from the private sector.

- Implement targeted policies that will attract foreign direct investment (FDI) into construction development (townships, housing, built-up infrastructure and construction development projects) and construction (infrastructure) activity.

- Resolve the bottlenecks and duplication of duties created by the establishment Acts of Bureau of Public Enterprises (BPE), Bureau of Public Procurement (BPP) and Infrastructure Concession Regulatory Commission (ICRC) on the roles of the agencies.

- While regulations exist to drive investment towards infrastructure development in the country, some of the provisions of the ICRC Act and National Policy on PPPs have also created disincentives to attracting the required investments. For instance, there is lack of clarity on ICRC's role either as a facilitator or as a regulator of PPPs in Nigeria.

- Develop and implement a robust infrastructure investment monitoring and reporting framework that will capture all infrastructure expenditures by private sector and Government Business Enterprises (GBEs). This will assist in accurate reporting of the country's infrastructure stock.

Note:

Exchange rate – 2019- ₦361.9/$, 2020- ₦382.2/$, 2021- ₦408.9/$, 2022- ₦424.5/$, 2023- ₦430.57/$

Footnotes

1 National Integrated Infrastructure Master Plan

2 Andersen Analysis

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.