01 INTRODUCTION

On 23 September 2022, the Luxembourg Administrative Tribunal (Tribunal Administratif, the "Tribunal", which is the first instance jurisdiction) held its decision (the "Decision") in a case that concerns an interest-free loan ("IFL") which has been granted by a Luxembourg company to its wholly owned Luxembourg subsidiary.1

The IFL has been treated as a debt instrument by the borrower and the lender that, respectively, performed a downward adjustment (i.e. deemed interest expenses) and an upward adjustment (i.e. deemed interest income) in their corporate tax returns in order to reflect arm's length conditions.

The Luxembourg tax authorities ("LTA") challenged this approach and considered that the IFL represented a hidden capital contribution and declined the tax adjustment (notional interest deduction) performed by the Luxembourg subsidiary (the taxpayer in the case at hand). The Tribunal confirmed the position of the LTA and rejected the complaint of the taxpayer.

At the time this article is drafted, an appeal against the decision has been filed with the Luxembourg Administrative Court (Cour Administrative, which is the second instance jurisdiction). As IFLs are a wide-spread phenomenon in Luxembourg, this case is of paramount importance. However, were the LTA and the Tribunal right when concluding that the IFL was a (hidden) capital contribution? This question will be analysed in detail in this article.

02 FACT PATTERN OF THE CASE

The case involved a company resident in the Cayman Islands ("CayCo") that invested, as from 2016, via a Luxembourg investment platform into (distressed) debt owed by third parties. Such debt instruments are commonly acquired at a price below nominal.

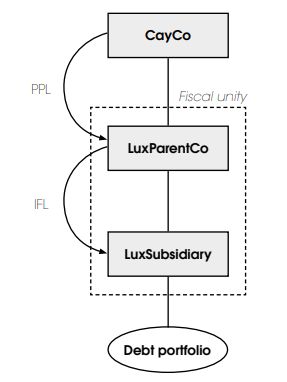

CayCo financed its Luxembourg subsidiary ("LuxParentCo") by a mixture of equity and a profit-participating loan ("PPL"). LuxParentCo used the funds received to finance its Luxembourg subsidiary ("LuxSubsidiary", the taxpayer) by a mixture of equity and (mainly) an IFL. In the Decision, it is stated that the IFL-to-Equity ratio was approximately 90:10 in 2016. LuxSubsidiary invested the funds received from LuxParentCo mainly into distressed debt instruments.

The following chart depicts the investment structure:

The IFL granted by LuxParentCo to LuxSubsidiary was formalised on 19 December 2016, whereas the funds had already been transferred on 29 April 2016. This belated formalisation of the IFL has been explained by the LuxSubsidiary with the speed and attention required to make the underlying investments. It has further been brought forward by LuxSubsidiary that the loan has been concluded between related parties so that there was no reason not to trust each other.

As from fiscal year 2017, LuxParentCo and LuxSubsidiary formed a fiscal unity (Article 164bis of the Luxembourg Income Tax Law, "LITL"). LuxParentCo and LuxSubsidiary filed a request for the application of the fiscal unity regime on 11 May 2017 which was confirmed by the LTA on 2 June 2017.

Apparently, LuxParentCo and LuxSubsidiary intended to apply the fiscal unity regime already as from fiscal year 2016 (i.e. the year in which both companies have been incorporated). This has been mentioned in the financial statements of LuxSubsidiary that expressly stated that the company was part of a fiscal unity with its sole shareholder. As such, it has been assumed by the Tribunal that the two companies omitted to file a request for the application of the fiscal unity regime in 2016.

LuxParentCo and LuxSubsidiary are Luxembourg companies that are subject to corporate income tax ("CIT") and municipal business tax ("MBT") at an aggregate rate of 24.94% (in Luxembourg City). In addition, both companies are subject to net wealth tax ("NWT") at an annual rate of 0.5% applied on the companies' unitary value (that is an adjusted net asset value). Given that the fiscal unity regime only applied as from 2017, both companies have been taxed on a standalone basis in 2016.

In 2016, LuxSubsidiary realised a gain in relation to its distressed debt portfolio which was subject to CIT and MBT. In its 2016 corporate tax return, LuxSubsidiary further performed a downward adjustment in relation to the IFL in order to account for deemed interest expenses that would have been due at arm's length. The downward adjustment has been made in accordance with Article 56 of the LITL.

The investments of LuxSubsidiary should be taxable assets for NWT purposes, whereas the IFL should be a deductible liability that reduces the company's unitary value if the IFL is classified as a debt instrument for tax purposes.

There are no indications that LuxParentCo realised any taxable income in 2016. However, LuxParentCo recognised deemed interest income in its corporate tax return (corresponding to the amount of the deemed interest expenses reflected in the 2016 corporate tax return of LuxSubsidiary). The upward adjustment was performed in accordance with Article 56 of the LITL.

As from 2017, LuxParentCo and LuxSubsidiary formed a fiscal unity. Accordingly, the taxable income of both companies was aggregated at the level of LuxParentCo that reported the consolidated taxable income in its corporate tax return. In 2017, no tax adjustments (upward or downward adjustment) have been made in respect of the IFL. The absence of tax adjustments in the 2017 corporate tax returns has been viewed by the LTA as an implicit acknowledgement that the IFL is not a debt instrument but a hidden capital contribution.

While the LTA may, for consistency purposes, require the same tax adjustments being made in the fiscal year 2017 (onwards), the deemed interest income and expenses would fully offset each other in the tax base of the fiscal unity. Thus, the recognition of deemed interest income and expenses would be merely a theoretical exercise without any practical implications in terms of tax liabilities. Therefore, the LTA should not attribute too much importance to the approach taken by the taxpayers as from 2017; it is no indication for the classification of the IFL by the taxpayers.

To view the ful article click here

Footnote

1 Administrative Tribunal, Decision No. 44902 of 23 September 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.