UPDATE: CloseCross is now live with our Pre-Launch

Access. Come and have a try here

CloseCross is the world's first truly decentralised derivatives platform driving democratic participation. By introducing simple 3-click-trading, eliminating unquantified risks, and making trading 90% cheaper, CloseCross gives everyone the opportunity to participate in the $1200 trillion financial derivatives market — without needing to be a financial genius with access to tons of money.

Decentralized. Democratized. Transparent.

We have made the tall claim that we WILL change the current derivatives industry with all its shortcomings. Let us now show you what exactly are we putting in place and how we will deliver on our promise of a decentralized derivatives that drive democratic participation

As you can see — we are focused on completely changing the financial derivatives market, and with a clear eye towards this purpose, we will continue to evolve and introduce more innovations at pace — so we can disrupt at scale.

Virtual Prediction Floors®

We start by implementing Virtual Prediction Floors® and deliver a world-first 3-click-trading interface for derivatives.

The Virtual Prediction Floor (VPF) is the most fundamental innovation that will continue to be the basis of future new roll-outs as well as other offers and products built on top of the base VPF concept. With the VPF, we simultaneously address all the drawbacks of the current modus operandi and in doing so democratize access to the derivatives space.

(Read more about how CloseCross pushes the boundaries of decentralisation and democratisation.)

Let's get into a bit of detail to ensure that everyone fully grasps how a VPF works and how users will be able to participate in it and make financial gains.

VPF — how it works

A VPF will always relate to a single Event. An Event is defined as a combination of a specific point in time and a specific underlying asset. For e.g. a VPF could be for price of Bitcoin at the end of today or for price of Gold in a week. A single underlying asset can have multiple VPFs open at the same time.

For example:

-Bitcoin price in 1 hour from now

-Bitcoin price end of today

-Bitcoin price end of week

- And so on...

Instead of multiple users going to a centralized party and buying call or put options, our VPFs will allow these same multiple users to enter a common space where they can directly deal between themselves instead of having a centralized party play the role in between for value exchanges amongst the said multiple users.

This is the basis of our approach to decentralized derivatives.

Let's say there are a 1000 people who would like to speculate on the price of gold at the end of the day today. Traditionally, each of these users will find a gold-based derivatives provider, purchase their call or put options and await the settlement when the price is known at the end of the day.

Using the CloseCross VPFs, these 1000 users can directly enter into a common smart contract that governs the VPF for price of gold at the end of today.

The values are then settled amongst themselves at maturity (end) time (in this example at the end of the day) using our patented multi-party settlement mechanisms and proprietary algorithms.

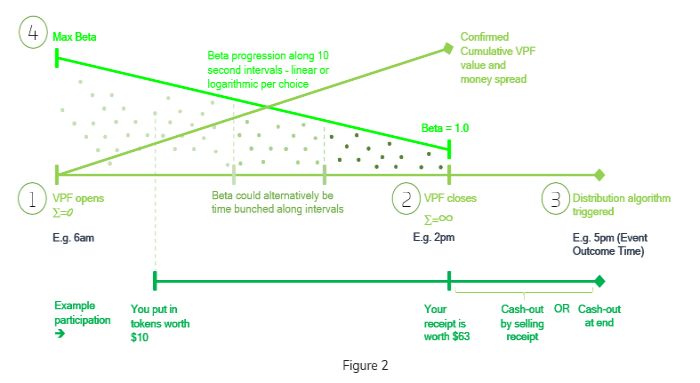

Every VPF will have these key elements (see Figure 2 above):

1. VPF opening time

2. VPF closing time

3. Event outcome time

4. Beta

Let's continue with the Gold 1-day VPF example to bring this to life.

At 5pm Eastern Time we would know the closing value of Gold for the given day. This is the "Event Outcome Time". If the earliest someone can make a commitment in our VPF is set to 6am of the same day, that is the "VPF Opening Time."

We would generally close the VPF to any new commitments before the actual closing value is known. So, in theory the VPF would close anytime before 5pm Eastern (the Event Outcome Time). If we stop accepting any new entrants to the VPF at 2pm, this is the "VPF Closing Time."

Explaining Beta

The Beta is a measure of how much volatility and risk exist at different points in time of the predictions being made by the user. It is pre-calculated and assigned to every VPF.

The principle is simple, the earlier you make your prediction, the less information you have and hence the risk you take in your prediction is higher.

For example: you make a prediction for price of gold at 6am, whereas I make a prediction at 9am. I have had the benefit of 3 hours worth of more information (news etc.) than you.

I have also had the chance to see what other VPF participants are predicting in the time period before 9am. Hence, with the added information and knowledge I have gained in these 3 hours, my risk is reduced.

This is a simplistic explanation of the Knowledge Value of Time algorithms (KVOTAs).

This risk is in turn reflected in the return you get. Now let's say that both you and I made the exact same prediction for the price of gold at 5pm Eastern, and that we both put in $10. Since you had a higher Beta you will get a much more return for your $10 compared to me. Hence, it is best to see the Beta as a rewards multiplier.

The earlier you enter the VPF, the higher profits you make — given you made the right prediction.

Range-bound options

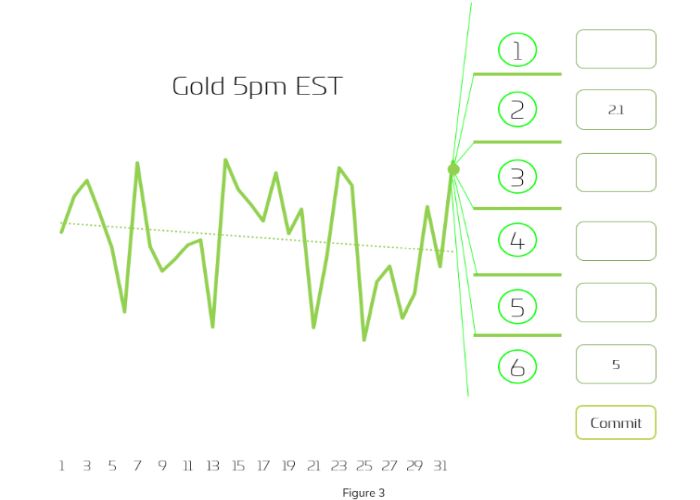

At CloseCross you will be given specific range bound options of which you can chose one or more to make your prediction.

Continuing with our example of price of gold with a Closing Time of today at 5pm Eastern, a user chooses option 2 and 6. One could interpret this as the user predicting a more or less heavily negative day with a minor chance of small upside. Hence 5 tokens on option 6 (heavy downside) and 2.1 on option 2 (marginally positive as against yesterday's closing price).

The range-bound option mechanism is key to bringing you the easy and intuitive 3-click trading system.

You simply pick your VPF (Gold 1-day), choose your range bound options and place tokens. You no longer need to go through lengthy and cumbersome processes to enter the derivatives market. In a few seconds, you can enter a VPF, make your prediction and get on with your life while the money works for you.

Connecting the dots

The dots in Figure 2 above illustrate different predictions made within a given VPF by different people. For each such prediction, users also commit a certain amount of funds to back their prediction — this can be as little as $0.01 and up to infinity. For each such prediction/commitment we will issue a receipt that is time stamped and block stamped. These receipts are used by the VPF participants to claim their rewards/ROI at the time of maturity (Event Outcome Time).

Continuing with our example VPF for the price of gold at the end of the day today. At the time you enter the VPF and make a commitment to a range bound option, you will lock in the time as well as the Beta prevailing at the time.

At the close of the VPF, you will know what the receipt is worth, provided the price range you predicted will turn out to be correct.

Remember you made your prediction at 6am and let's say that at the VPF Closing Time you find out that your receipt is worth $63 — if price of gold at the end of today hits the range bound option you chose. Since I made the prediction at 9am, my $10 will have a lower receipt value than $63 — let's just say its $40.

You see now that even though we both made the same prediction and committed the same value to our prediction, the profit we make is vastly different due to the difference in time of entry in the VPF.

If you've made it this far, it is worth it to spend a few more minutes and watch our demo video here (at the top of this post). Or you can see it here.

Seeing is believing and we want you to believe!

We will launch a global beta in testnet mode and invite early adopters to test our mobile application. This will give everyone a chance to get acquainted with the platform and see how the decentralized derivatives work in a completely safe environment before they can jump into real trading.

There will also be a chance for these early adopters to earn CloseCross tokens through their active engagement, participation in VPFs and by inviting others to join CloseCross beta testnet phase.

If you want to hear about it first, join our community at https://t.me/CloseCrossCommunity

Further Innovations

We are clearly focused on how to continue rolling out further innovations to the market and continuously increasing democratic participation as well as have a larger offer portfolio so that we can address a larger part of the market including institutional traders.

We are committed to meeting the unmet needs across the entire population and creating the democratic market where participants continue to interact between themselves in an ever more engaging manner.

Check back here to see the second and concluding chapter soon!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.