When CAIA approached me to write the closing piece for Innovation Unleashed: The Rise of Total Portfolio Approach from the eyes of a practitioner and advisor, I eagerly accepted the opportunity. Total Portfolio Approach (TPA) is an approach that WTW had adopted early in how we think about implementing portfolios, but it didn't just "happen" overnight. Like any enduring idea, our understanding of TPA and the subsequent papers we wrote on the subject were shaped by our own observations, experience, trial and error, and the support of asset owner partners who joined us on the journey.

After working in consulting for two decades, I can confidently say that strategic asset allocation (SAA) is ubiquitous across most of the clients I work with. It fits the idea of clear accountabilities and separation of duty. The Board sets investment policy and the investment team focuses on implementation. Investment teams wait anxiously to hear how the SAA dictates their allocation and deployment that year. Success is measured as alpha above mandate benchmarks in neat asset class rows. The governance and associated incentive structures couldn't be cleaner.

However, as the world of investing becomes more complex, SAA models more intricate, and the requirements for the Board to be on top of an ever-expanding list of interconnected asset classes, cracks in this façade inevitably show. Today, I still work with clients who tirelessly seek the magic top-down number for sub-asset class A or the proxy benchmark that best represents asset class B. While those with a quantitative mindset may find clever workarounds to solve the technical aspects of this issue, the fundamental problem remains—today's investment environment has stretched traditional SAA governance models beyond the point of effectiveness for most Boards.

Enter Total Portfolio Approach or TPA—also known as 'one-portfolio approach.' TPA is neither model nor method, but rather a term used to encapsulate a different approach to investment strategy. One that is arguably more about changing the governance, culture, and how people are incentivised rather than a fancy way of modelling assets. There is no definition for TPA in academic literature, but practitioners often point to Canada and New Zealand as early adopters of the approach. In both cases, the main motivation for the shift in approach was to change the governance model in a way that would enable more effective and innovative asset management. However, no change comes without risks, and the innovation that was TPA was only made possible because early adopters believed the benefits outweighed the risks.

Total Portfolio Approach (TPA) can be defined as one unified means of assessing risk and return of the whole portfolio.

Geoffrey Rubin

Senior Managing Director, One Fund Strategist CPPIB

Prior TPA Study

In 2019, WTW's Thinking Ahead Institute conducted a global study on asset owners (AOs) and their asset allocation practices, with a specific focus on those who embraced total portfolio thinking. While there were many variations in the actual portfolio construction strategies employed by different institutions—50 shades of grey, in a way—there were several key commonalities worth noting. These included:

As we can see from the aforementioned points, TPA encompasses both 'hard' or tangible factors, and 'soft' or intangible factors that are interconnected and must be aligned for successful implementation. Let's explore these factors further.

Taking the first point. For TPA adopters the mantra that "the Board owns the SAA" no longer applied. Rather, the Board managed overall investment risk, often via a reference portfolio or policy portfolio. This is deceptively simple to say but devilishly difficult to pull off—to the point that AOs participating in the study acknowledged that starting from a 'blank slate' was a core competitive advantage in adopting TPA as seen in examples such as Future Fund and CPP Investments. In simple terms, getting the Board to delegate SAA to the investment team is a prerequisite for TPA success, and a key driver of increased dynamism in the investment approach. Moving to the second and third points, TPA adopters abandoned rigid asset class buckets and adopted a dynamic capital allocation strategy to achieve their total fund goals. This shift requires the ability to look beyond conventional asset class labels and develop the capability to express dynamic views. This newfound agility is seen as a valuable source of investment alpha, prompting an expansion of the capital markets team size and skill set.

The fourth point relates to culture and how teams and individuals are incentivised based on their contributions to overall portfolio performance. This aspect presents a more complex challenge as it involves not only aligning organisational systems but also shaping behaviour and mindset.

TPA – Not For The Faint-Hearted

By now, it should be abundantly clear that adopting TPA is a full-on transformation exercise, and not something to be embarked on lightly. This naturally raises several important questions. What are the benefits that justify making such a transition? Is it feasible to shift from one legacy system to another? What are the costs associated with such an undertaking? How does one go about doing it, and what can people learn from others who have navigated this transition to ensure a higher chance of success? Most importantly, is moving to TPA the right choice for you?

Developments

The rationale or 'why' behind adopting a dynamic and integrated investment approach has been discussed previously, but let's recap. The key reason AOs turn to this approach is to navigate the increasing complexity of investments, where traditional governance structures fall short.

The early adopters often had the advantage of a clean slate, with changes in leadership, mandates, or governance models providing the flexibility to explore new strategies. Additionally, the Global Financial Crisis (GFC) played a crucial role in pushing funds towards alternative allocation frameworks, redefining risk management practices, and fostering agile decision-making.

TPA Best Practice Checklist

While it may be premature to claim widespread adoption of TPA today, it is fair to say that since the post-GFC period, starting around 2010, there has been a significant increase in funds professing to embrace TPA strategies or thinking. Many of the reasons for this shift can be attributed to the limitations of the existing SAA paradigm. During a workshop WTW's Thinking Ahead Institute conducted with AOs in 2020, three key reasons were cited for adopting TPA:

I don't believe any of the AOs present that day (who are clearly self-selected given they were members of a TPA working group attending a TPA symposium!) would have advocated to go back to the prior SAA approach. But it's also interesting to note that a good chunk of the discussion centered around the challenges of adopting and implementing TPA.

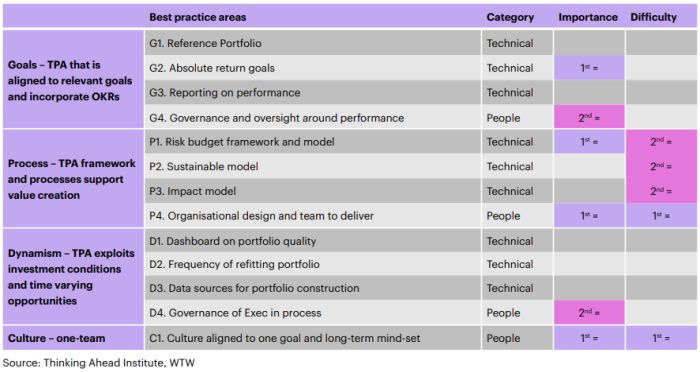

To provide a visual representation of WTW's perspective on successful TPA implementation, the above schematic outlines thirteen areas of best practice. These are categorised into either 'hard' (i.e., technical) or 'soft' (i.e., people) strands, and organised into four categories – Goals, Process, Dynamism, and Culture. Not all the points are mutually exclusive, and many are interlinked.

Based on the above, there are a couple of TPA myths that can be dispelled immediately. One common misconception is that TPA requires a reference portfolio. While a reference portfolio can be helpful, especially during the transition from an established strategic asset allocation (SAA), it is not a prerequisite for TPA adoption. Interestingly, around half of the participating AOs employed a reference portfolio, but the other half did not, and many in this latter group had no plans to incorporate it in the future.

What does come across clearly is the focus on absolute return goals over relative which is seen to be of paramount importance. This helps to dispel another myth that may not be immediately evident from the table shown above. There is a belief that pension funds are less suited to TPA compared to funds with absolute return mandates or CPI+ return targets, such as Sovereign Wealth Funds. However, if anything, TPA adopters are actively seeking to address the challenges associated with SAA, many of which stem from constraints imposed by legacy governance models. This is a significant concern for many pension funds, and in fact, many of the TPA early adopters themselves were pension funds!

One final but fascinating observation is the emphasis on 'soft' strand. For each of the thirteen areas of best practice, AOs were asked to select the factors that were first or second in terms of 'importance' and 'difficulty.' But the two areas that were ranked first priority on both counts were people issues revolving around organisational design and cultural alignment. In my personal discussions with TPA adopters, the issue of changing people's behaviour and incentive systems to enable TPA is brought up time and time again as being vital to the successful implementation of TPA.

At this point, I should add that we are not merely observers here. WTW has long embraced TPA thinking in the way we approach portfolio construction, even before it was labeled as such. I believe this stems naturally from our role as strategic or policy advisor and more recently as Outsourced CIO. In this capacity, we need to constantly be mindful of our clients' final portfolio outcomes. This has naturally influenced the way we organise our organisational alpha (a combination of governance, culture, talent, and technology) and our investment alpha (by risk factor), as well as why we include culture as part of our assessment process for managers. In other words, we have conviction in our belief that TPA is worth doing.

Practical Implementation

In terms of the practicality of making the move to TPA and how to increase the chances of success, I don't believe there is a magic formula, but I can offer some advice based on my experience. I assume that, like many of my clients, you have a well-established and disciplined approach to SAA that has been nurtured over many years already.

Recognize that adopting TPA is a change management process, and one that requires bold leadership and vision.

First and foremost, recognise that adopting TPA is a change management process, and one that requires bold leadership and vision. Organisations with a rotating or politically appointed executive function may face challenges in implementing this approach, as longevity is essential to drive real change, especially when it involves multiple facets of the organisation—such as the governance structure, investment teams and processes, organisational design, remuneration structure, and culture.

Secondly, carefully consider why you are pursuing this change. The primary reason cited by most adopters is the desire for greater dynamism and agility. While this may sound appealing in theory, it is crucial to assess the practicality of this goal within your own organisation. Many of the funds I work with are governmental or public in nature, and their underlying culture often prioritises prudence and caution. It is worth noting that most TPA adopters share similar affiliations, yet they consciously choose to embrace a highly dynamic investment approach. This can lead to increased complexity, larger teams, and, frankly, higher internal costs. To embark on this journey, you must genuinely believe that the benefits of achieving agility outweigh the associated costs.

Thirdly, please be aware that this will be a multi-year process that will require ongoing commitment and pretty much constant adaptation. The change will require buy-in from your Board, the management team, and your underlying investment teams and staff. New processes will need to be implemented and new behaviours will need to be learned. Leadership will need to be united in promoting the right culture to support total portfolio thinking and avoid inherent selfish behaviours.

Earlier, I mentioned that TPA is not something to be embarked on lightly, but that doesn't mean I believe it isn't a pursuit worth undertaking. As with most things in life, nothing worth having comes easy, but that doesn't mean it has to be hard. Remember that TPA is not a specific model with a singular destination, but rather a range of approaches that can be tailored to the unique needs of different asset owners, regardless of their size or complexity. Even if a full transformation seems challenging, you can begin by introducing TPA strategies into your portfolio, or partnering with an OCIO who implements TPA, or simply fostering a TPA mindset and culture. The key is to embrace change and take that first step that aligns with your circumstances.

Still Learning

Recently, I had the privilege of collaborating with a prominent asset owner in Asia who was actively exploring TPA with the intention of eventually adopting it to suit their unique requirements. During this process, we had the opportunity to interview several of their TPA peers— early adopters of TPA. One intriguing comment that consistently emerged from these conversations was the recognition of the need to "simplify" and find ways to address the complexity that TPA had introduced. This revelation came as a surprise to the AO sponsor, who had regarded TPA as a shining example of innovation to emulate. However, learning about the practical implementation challenges was truly eye-opening. I was particularly fascinated by the peer funds' willingness to acknowledge these hurdles and the significant measures they had taken to overcome them, often deviating from their initial approach. This further emphasised to me that TPA is an ongoing process that will continue to evolve.

On that note, I strongly encourage all of us to remain open-minded. We are all still learning, and the future is not set in stone. TPA is still in its early stages, but its transformative potential is undeniable, especially when compared to SAA. We will continue to observe developments in this area with plans to refresh our research on TPA through a new asset owner peer study which is planned for next year. We hope this will provide an opportunity to delve deeper into the evolving landscape of TPA as well as explore ways to make TPA more accessible to all asset owners.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.