The European Commission, on July 20, 2021, unveiled a landmark legislative proposal1 that would overhaul the European Union's approach to anti-money laundering and combatting the financing of terrorism ("AML/CFT"), creating a Union-wide AML/CFT supervisor2 and introducing a common AML/CFT Rulebook3 ("the Rulebook") that will apply directly to obliged entities in all member states. The Commission also proposed a new AML/CFT Directive4 ("AMLD6") that imposes higher standards for the operation of national AML/CFT regimes. The European Commission's proposal follows several years of AML scandals for the EU and EU financial institutions (FIs), including accusations that the Estonia branch of Danske Bank laundered more than USD 200 billion originating in Russia,5 and a proposal by the U.S. Treasury Department to designate Latvia-based ABLV as an institution of primary money laundering concern under the USA PATRIOT Act.6 Implementation of the EU proposal—if passed—is likely to overlap with that of another major AML/CFT reform, the U.S. Anti-Money Laundering Act (also known as AMLA), which was signed into law in 2021.7 Both are legislative responses to the FATF's call for greater effectiveness and sustainability of national AML/CFT regimes amid rapid innovation in the financial sector.

- The proposal includes a regulation establishing the AML Authority ("AMLA"), an entirely new and independent European Union (EU) agency with a staff of 250, that will have the power to directly supervise certain high-risk cross-border obliged entities and to issue technical standards and guidance that apply directly throughout the Union. AMLA is also envisioned as a coordinating and oversight body for national supervisors and will offer a cooperation mechanism for national-level financial intelligence units (FIUs).

- The Rulebook incorporates and expands on the provisions of the EU's existing AML/CFT legislation, AML Directives 4 and 5. The Rulebook, however, would immediately and directly apply to all obliged entities, as opposed to the current Directives, which must first be transposed into national law. Not all member states have fully transposed the Directives, creating variations in requirements throughout the EU. The Rulebook is also frequently more detailed and prescriptive than the Directives.

- AMLD6 significantly expands and strengthens existing guidelines related to the structure and organization of national AML/CFT regimes. It imposes more rigorous and detailed requirements related to the status and function of national-level FIUs, cross-border cooperation between national supervisors, the status of self-regulatory bodies, and registers of beneficial owners.

If implemented as drafted, the proposed new EU regime would raise global standards in certain areas, creating potential implementation challenges for U.S. and global FIs with European operations. The Rulebook is generally in line with current U.S. supervisory expectations, but imposes certain requirements that exceed the Financial Action Task Force (FATF) standards and are not explicitly captured in U.S. law and regulation. As a result, global and U.S. FIs with a European presence may need to review and update their group-wide AML/CFT program.

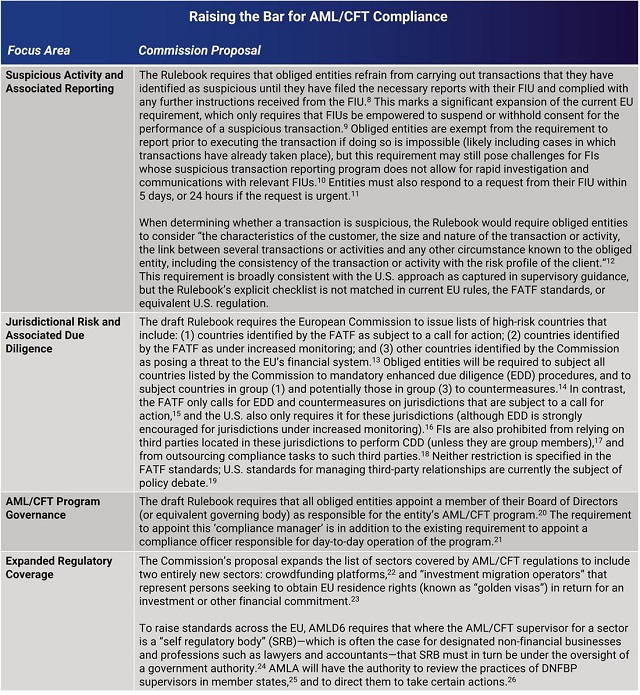

*Click here to view this table on a mobile device.

In addition to the changes that move the EU regime beyond the FATF standards, other aspects of the Commission's proposal focus on harmonizing requirements throughout the bloc and across sectors, promoting an EU-wide approach to AML/CFT, particularly for financial groups. Among these reforms are elements related to critical areas of an AML/CFT regime such as information-sharing and beneficial ownership.

*Click here to view this table on a mobile device.

The proposal gives AMLA full enforcement and sanctions powers over those FIs that it supervises directly, which would be critical to meaningful implementation of the new regime. An active supra-jurisdictional supervisory body would potentially increase enforcement risk for FIs, particularly those that operate across the bloc and are systemically significant to the EU's economy. AMLA would also be empowered to apply direct pressure on national financial supervisors to urge them to take action against FIs or other obliged entities that AMLA does not directly oversee, and could in certain cases take over supervision of an FI on an emergency basis when it believes national supervisors are not taking sufficient action to deal with AML/CFT violations.

- AMLA would be required to periodically conduct a risk assessment of the country-level operations of all credit institutions operating in at least seven member states, and all other FIs operating in at least 10 member states.45 AMLA must directly supervise all credit institutions that are rated high risk in at least four member states and that have been under investigation in at least one member state in the past three years, and all other FIs that are rated high risk in at least six member states.46

- AMLA is empowered to conduct off-site and on-site inspections for all FIs subject to its direct supervision.47 Where it discovers violations, it is empowered to require the FI to take certain actions to remediate violations, including changes in the governance structure and specific requirements related to individual clients or transaction types,48 and to impose financial penalties up to 1% of annual turnover.49 Where an entity refuses to take the actions AMLA requires, the authority can also impose daily penalties of up to 3% of average daily turnover for up to six months.50

- Where AMLA believes that an entity not under its direct supervision has materially breached AML/CFT requirements, it can request that the entity's supervisor investigate such potential breaches and take enforcement action. Where the supervisor concerned does not respond adequately, AMLA can request that the Commission transfer supervisory powers from the national supervisor to AMLA.51

FIs, including both European FIs and global FIs with European operations, should track progress of the proposal, plan for new obligations that will require major changes to their operations, and prepare for a lengthy implementation period. If passed, the proposals would take at least five years to fully implement, with AMLA not expected to become fully operational until 2026, although it should begin to issue guidance before that time.

Footnotes

1 European Commission, "Beating financial crime: Commission overhauls anti-money laundering and countering the financing of terrorism rules," Press Release, July 20, 2021, https://ec.europa.eu/commission/presscorner/detail/en/ip_21_3690.

2 Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the Authority for Anti-Money Laundering and Countering the Financing of Terrorism and amending Regulations (EU) No 1093/2010, (EU) 1094/2010, (EU) 1095/2010 ("AMLA Regulation"), http://ec.europa.eu/finance/docs/law/210720-proposal-aml-cft-authority_en.pdf.

3 Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing ("Rulebook Regulation"), https://ec.europa.eu/finance/docs/law/210720-proposal-aml-cft_en.pdf.

4 Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on the mechanisms to be put in place by the Member States for the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and repealing Directive (EU) 2015/849 ("AMLD6"), https://ec.europa.eu/finance/docs/law/210720-proposal-amld6_en.pdf.

5 Steve Kroft, "How the Danske Bank money-laundering scheme involving $230 billion unraveled," 60 Minutes, May 19, 2019, https://www.cbsnews.com/news/how-the-danske-bank-money-laundering-scheme-involving-230-billion-unraveled-60-minutes-2019-05-19/.

6 Financial Crimes Enforcement Network, "FinCEN Names ABLV Bank of Latvia an Institution of Primary Money Laundering Concern and Proposes Section 311 Special Measure," February 13, 2018, https://www.fincen.gov/news/news-releases/fincen-names-ablv-bank-latvia-institution-primary-money-laundering-concern-and.

7 K2 Integrity, "National Defense Authorization Act (NDAA) 2021: Landmark AML Reforms Pass Congress," December 18, 2020, https://www.k2integrity.com/en/knowledge/policy-alerts/national-defense-authorization-act-ndaa-2021-landmark-aml-reforms-pass-congress.

8 Rulebook Regulation, Article 52(1).

9 DIRECTIVE (EU) 2015/849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, amending Regulation (EU) No 648/2012 of the European Parliament and of the Council, and repealing Directive 2005/60/EC of the European Parliament and of the Council and Commission Directive 2006/70/EC ("AMLD4"), Article 32(7).

10 Rulebook Regulation, Article 52(2).

11 Rulebook Regulation, Article 50(1).

12 Rulebook Regulation, Article 50(2).

13 Rulebook Regulation, Articles 23-25 and Paragraph 51.

14 Rulebook Regulation, Articles 24 and 28.

15 See, e.g., FATF, "Jurisdictions under Increased Monitoring - June 2021," which states that "the FATF does not call for the application of enhanced due diligence measures to be applied to these jurisdictions" but encourages jurisdictions to take into account the information FATF presents on deficiencies in national AML/CFT regimes. https://www.fatf-gafi.org/publications/high-risk-and-other-monitored-jurisdictions/documents/increased-monitoring-june-2021.html.

16 See, e.g., FinCEN Advisory FIN-2021-A003, "Advisory on the Financial Action Task Force-Identified Jurisdictions with Anti-Money Laundering and Combating the Financing of Terrorism and Counter-Proliferation Deficiencies," March 11, 2021, https://www.fincen.gov/sites/default/files/advisory/2021-03-11/FATF%20February%202021%20Advisory%20FINAL%20508.pdf.

17 Rulebook Regulations, Article 38(4).

18 Rulebook Regulation, Article 40(1).

19 See, for example, recent proposed joint guidance on third-party relationships issued for comment by the federal functional financial regulators: Proposed Interagency Guidance on Third-Party Relationships: Risk Management, July 13, 2021, https://www.fdic.gov/news/press-releases/2021/pr21061a.pdf.

20 Rulebook Regulation, Article 9(1).

21 Rulebook Regulation, Article 9(3).

22 Rulebook Regulation, Article 3(h).

23 Rulebook Regulation, Article 3(l).

24 AMLD6, Article 38.

25 AMLA Regulation, Article 31.

26 AMLA Regulation, Article 32.

27 AMLA Regulation, Articles 38 and 43.

28 Rulebook regulation, Article 50(3).

29 Rulebook Regulation, Articles 23-25.

30 Rulebook Regulation, Article 43(3).

31 Rulebook Regulation, Article 33.

32 Rulebook Regulation, Article 13(2).

33 Rulebook Regulation, Article 48(1)(a).

34 AMLD6, Article 10(1).

35 AMLD6, Article 10(2).

36 AMLD6, Article 10(7).

37 AMLD 6, Article 11(1).

38 Rulebook Regulation, Paragraph 6 and Article 3(g).

39 Rulebook Regulation, Article 58(1).-

40 Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on information accompanying transfers of funds and certain crypto-assets, https://ec.europa.eu/finance/docs/law/210720-proposal-funds-transfers_en.pdf.

41 Rulebook Regulation, Article 40(2).

42 Rulebook Regulation, Article 41.

43 Rulebook Regulation, Article 59(1).

44 Rulebook Regulation, Article 59(2).

45 AMLA Regulation, Article 12.

46 AMLA Regulation, Article 13.

47 AMLA Regulation, Articles 17 and 18.

48 AMLA Regulation, Article 20(2).

49 AMLA Regulation, Article 21.

50 AMLA Regulation, Article 22.

51 AMLA Regulation, Article 30.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.