To view the original report please click here.

INTRODUCTION

We remain cautiously optimistic about the prospects for activity in the international infrastructure market. This is supported by our new study and by the sustained levels of activity since the onset of the credit crunch. However, asset price levels remain uncertain, with buyers' and sellers' expectations significantly mismatched, and this has held back transactional activity.

Several major infrastructure transactions have closed recently, including Future Strategic Tanker Aircraft (FSTA) and the acquisition of Angel Trains. In addition, the long-anticipated Pennsylvania Turnpike acquisition and the BAA refinancing are expected to come to market during the next few months (see page 4). These are market-defining transactions.

Looking ahead, high-speed rail programmes in Portugal and Poland, the ongoing public private partnerships (PPP) road programme in Russia and India and P3s in the US are all in the pipeline.

We believe that origination and trading activities will continue to be driven by the Organisation for Economic Co-operation and Development (OECD) public sector's inability to fund its infrastructure requirements, the infrastructure needs of emerging economies and by the need of infrastructure promoters to release invested capital.

The key conclusions that we draw from our study are:

- participants are relatively positive about the outlook for the

next 12 months;

- 'traditional' projects – energy and hard

transport projects – will continue to attract the

greatest attention from investors and credit providers; and

- energy utilities and renewables are likely to provide the

highest levels of activity.

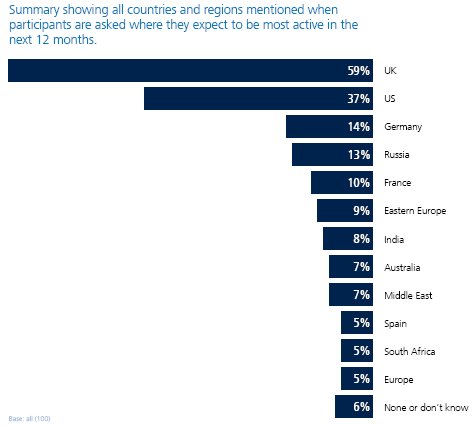

Perhaps the most surprising finding was the strength of the market in the OECD countries compared with that in the emerging economies. People anticipate that the UK will be the most active market over the next 12 months, followed by the US. To encourage private sector investment, the emerging markets need a stable government, a reliable legal system, control of corruption levels and a supportive policy framework.

We commend Outlook for infrastructure: 2008 and beyond to you and hope you will find it interesting and thought provoking.

KEY FINDINGS

We spoke to 100 Europe-based senior executives who are involved in global infrastructure projects and based in Europe. The objective was to find out their attitudes to the global infrastructure market and their views on future market activity.

Despite the credit crunch, participants are relatively positive about the outlook for the infrastructure sector over the next 12 months: 53 per cent are either as optimistic as or more so than they were a year ago.

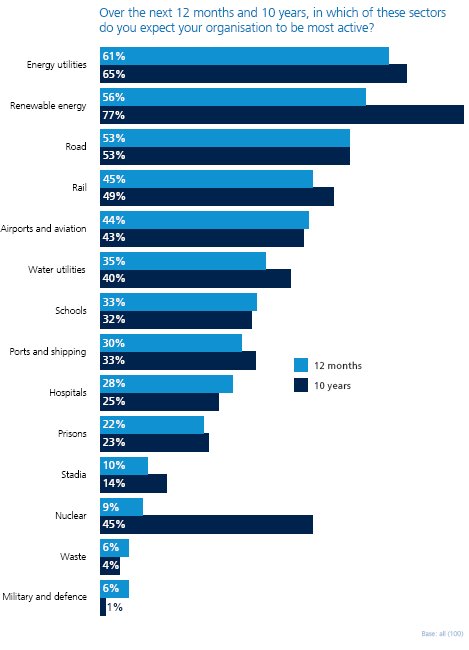

Energy Utilities And Renewables Are Likely To Provide The Highest Levels Of Activity

- 'Traditional' projects – energy (including

renewables) and hard transport projects (road, rail and airports)

– will continue to attract the greatest attention from

investors and credit providers. Participants anticipate most

activity over the next 12 months in: energy utilities (61 per

cent), renewable energy (56 per cent) and roads (53 per cent), with

rail and aviation featuring highly at 45 and 44 per cent.

- The market in the OECD countries is strong compared with that

in the emerging economies: the top four countries in terms of

expected activity levels over the next 12 months are OECD

ones.

People Anticipate That The UK Will Be The Most Active Market Over The Next 12 Months

- The key factors influencing private sector investment activity

in the emerging markets are: a stable government (mentioned by 76

per cent), a reliable legal system (76 per cent), the control of

corruption levels (74 per cent) and a supportive policy framework

(71 per cent).

- Clearly, emerging markets need to invest further effort in

fashioning robust legislative and policy frameworks to attract and

retain the attention and resources of private sector

participants.

CAUTIOUSLY OPTIMISTIC

Our view is that market interest in infrastructure and transport assets continues to be strong. However, our relative optimism is tempered largely by constraints within the debt markets: the increasing cost of debt, continued downward pressure on individual credit providers' exposure levels, the tightening of covenant packages and limited accessibility to the capital markets.

Optimism Levels: Number And Value Of Deals

Despite market conditions, a number of major infrastructure transactions have recently closed, including, most notably:

- FSTA with a £2.2bn senior debt requirement (plus

£105m mezzanine and £180m equity bridge facilities);

and

- the acquisition of Angel Trains with a £3bn combined

senior and junior debt requirement.

In addition, the long-anticipated $12.8bn acquisition of the Pennsylvania Turnpike and the multi-billion-pound BAA refinancing are expected to come to market during the next few months.

Looking into the future, deals in the pipeline include high-speed rail programmes in Portugal and Poland, the marketing of the Babcock & Brown global windfarm portfolio, the PPP road programme in Russia and India and additional PPPs (P3s) in the US (among other large-scale infrastructure transactions).

Overall, therefore, participants in our study remain quite optimistic about the infrastructure and transport sectors over the next 12 months: the majority (53 per cent) are either as optimistic as or more so than they were 12 months ago. Notably, participants feel that both the number and the value of European infrastructure deals in which they will be involved will either remain at the same level or increase (73 and 69 per cent respectively) when compared with activity over the past year.

Investors (80 per cent) are more optimistic than credit providers (60 per cent) in terms of the number of European deals that they anticipate will be undertaken, but the two groups are closer in their assessments of the value of deals: 68 per cent of investors and 60 per cent of credit providers think values will either remain at the same levels or increase.

Areas Of Most Activity: The Next 12 Months

The areas in which participants anticipate most activity over the next 12 months are energy utilities (61 per cent), renewable energy (56 per cent) and roads (53 per cent), with rail and aviation featuring highly at 45 and 44 per cent. Social infrastructure projects such as schools, hospitals and prisons feature less prominently.

There is a divergence between investors and credit providers over the sectors in which they expect their organisations to be most active, with investors focusing on energy utilities and renewable energy but credit providers identifying roads as their most active sector.

Areas Of Most Activity: The Next Decade

When it comes to the 10-year forecast, investors and credit providers agree that the greatest growth opportunities will be in energy utilities and renewable energy, ahead of transport infrastructure such as road, rail and airports. Perhaps a surprising finding is that opportunities in nuclear over the next 12 months come very low down the scale, although – unsurprisingly – the 10-year forecast shows a much higher profile for this industry.

This focus on energy utilities and renewable opportunities over both the short and longer terms reflects a combination of factors:

- the high oil price, providing an incentive to invest in energy

projects previously regarded as marginal;

- opportunities presented by the unbundling of the European

energy market;

- governments' desire to achieve energy security;

- the demand and growth of energy requirements in the emerging

markets; and

- the regulatory and socially driven impetus for the energy

sector to respond to climate change (for example, government

subsidies and incentives to invest in renewable energy and recently

announced changes to the UK planning process that aim to encourage

greater investment in nuclear energy).

The continued strength of interest in hard transport infrastructure (road, rail and airports) reflects the attractiveness of the long-term stable financial returns that such assets are capable of delivering to a growing group of investors, including infrastructure funds, pension funds and sovereign wealth funds.

THE CREDIT CRUNCH: PRICING AND VOLUME

The large infrastructure deals of 2006 (such as the Ferrovial-led consortium's acquisition of BAA and Macquarie's acquisition of Thames Water) were sustained by the availability of cheap and readily available debt.

The debt markets have clearly undergone a radical change since August 2007 and a number of themes have emerged:

- higher levels of equity;

- vendor loans (to sustain, as far as possible, vendor exit price

expectations); and

- an almost-total closure to infrastructure deals of the monoline

wrapped bond market (exacerbated by the recent MBIA and Ambac

downgrades) and a consequent increased reliance upon bank debt,

higher debt margins, reduced ticket sizes on the part of banks,

tighter covenant packages and more conservative financial

ratios.

Current high-profile deals in the course of development, such as the bank and bond financing of the $12.8bn Pennsylvania Turnpike in the US and the multi-billion-pound BAA refinancing in Europe, will be the bellwether deals for the infrastructure and transport sectors in the next 12 months.

Market Pricing And Activity Levels

We asked participants whether they feel that market prices have adjusted in the light of the credit crunch. Although the overwhelming view is that sellers' price expectations are too high, the study is inconclusive over whether asset prices have actually undergone a correction (48 per cent feel that prices have reduced, 42 per cent feel either that prices have not reduced or that it is too soon to tell and 10 per cent believe prices have actually increased).

What this split of market sentiment demonstrates is a general air of pricing uncertainty – whether to be a buyer or a seller? – and this, taken with the general tightening of credit availability and terms, has led to a reduction in post-credit crunch deal activity. Dealogic's records of global infrastructure transport deal flow over the past 18 months show a 40 per cent drop in the number of deals completed for Q1 and Q2 2008 compared with the same period for 2007. There was a 34 per cent drop by value over the same period.

As for anticipated sources of funding for deals over the next 12 months, bank debt and infrastructure fund equity lead capital market products by a significant margin. However, it is clear that participants see the capital markets as an important source of capital: 57 per cent identify them as such, although 85 and 82 per cent of participants identify, respectively, the use of bank debt and equity.

GLOBAL DEMAND FOR INFRASTRUCTURE

The BRIC emerging economies have been heralded as the infrastructure and transport sectors' fertile new ground.

However, as the 2006-7 OECD report Infrastructure to 2030 highlighted, OECD countries continue to be the most significant players in these sectors. This is because insufficient public funding is available in OECD countries to satisfy the competing demands for improving and expanding existing infrastructure and responding to the health and social needs of aging populations.

Recent US P3 experience has clearly borne out the OECD report's findings, both in terms of numbers of deals closing and their value and in the development of P3 policies in the infrastructure and transport sectors.

The OECD countries' role in infrastructure and transport investment reflects where the survey participants' organisations are prioritising their activity over the next 12 months. The top four countries in terms of expected activity levels are OECD ones: the UK, the US, Germany and France.

Only 7 per cent of participants nominate the Middle East as the area of greatest activity for their organisations, with 13 per cent identifying Russia and 8 per cent India as countries of greatest activity.

These findings can be explained by the comparative maturity of the UK market and the sheer size and scale of the development and investment opportunity available in the US where, in addition to the Pennsylvania Turnpike, a number of big-ticket deals are expected to come to the market over the next four to six months (including Chicago Midway Airport, Chicago Parking Meters, Long Beach Courts and various road schemes).

Emerging Economies: Issues Of Concern

As expected, India, Russia, China and Eastern Europe are named as the emerging economies most in need of infrastructure investment.

We asked participants to identify the bare minimum requirements for their organisations to become involved in an infrastructure deal in an emerging economy. The responses illustrate why their organisations are not prioritising the emerging economies ahead of the OECD countries: 76 per cent identify the need for a stable government and a reliable legal system, closely followed by 74 per cent identifying the need for corruption levels to be controlled and 71 per cent for supportive government policies.

Clearly, emerging markets need to invest further effort in fashioning robust legislative and policy frameworks to attract and retain the attention and resources of private sector participants.

Russia emerges as the country that is perceived as the most difficult in which to develop an infrastructure project. The Russian public sector is aware of this issue and is seeking to address it – as demonstrated by the Russian Federation's enacting the Federal Law on Concessions in 2005 to encourage PPPs in infrastructure and transport projects and the amendments to that law, which will be enacted in the near future. There are four toll road projects, a light rail project and an airport project competing for foreign investment. The closing of a Russian toll road transaction will undoubtedly assist in encouraging market participation.

ABOUT THE SURVEY

The survey was carried out by conducting 100 telephone interviews with senior executives in the European infrastructure and transport industry who are regularly involved in global infrastructure projects.

The majority of participants are investors and credit providers, with the balance being consultants or industrial players who operate across all sectors, from traditional or 'hard' infrastructure, such as energy and transport, to social infrastructure such as hospitals, schools and prisons projects.

Interviews were carried out between 22 May and 3 June 2008.

To view the original report please click here.