We looked at current trends in CEO remuneration, the impact of globalization on executive pay in Europe, AGM season of 2024, and the findings from our latest collaboration with ecoDA.

Companies across Europe are navigating dynamic times in executive compensation amidst ongoing macroeconomic volatility and persistent uncertainty. While the say-on-pay votes on remuneration policies/systems and reports have become well-established in the region, it is important to recognize that this system is not static. The level of external scrutiny by investors and proxy advisors is steadily increasing.

On February 27, we hosted our first European-wide Executive Compensation & Board Advisory webcast for 2024. We engaged with nearly 300 clients to delve into current trends in CEO remuneration, the impact of globalization on executive pay in Europe, key developments to guide us through the AGM season of 2024, and the findings from our latest collaboration with ecoDA on the future of European Non-Executive Director compensation.

Expected changes in CEO remuneration for 2024

In our latest Executive Pay Memo: European CEO compensation trends and AGM season 2023, we reported a 7% increase in median target total direct compensation to nearly four million Euros in 2022 for Chief Executive Officers across the top indices of nine European countries. However, there is a significant disparity in median levels across countries, ranging from close to two million Euros in Belgium to slightly above seven million Euros in Switzerland. Looking ahead to 2024, we anticipate that base salary increases will be below inflation levels. We expect pay increases to be primarily observed in variable compensation, particularly in increased Long-Term Incentive (LTI) levels. Additionally, we are noticing that some companies are reevaluating their LTI vehicle mix. Particularly at levels below the board, the utilization of restricted shares is becoming more prevalent to ensure retention and competitiveness with other markets globally.

ESG metrics are already highly prevalent across Europe, with 88% of top European companies incorporating them into their short-term incentive (STI) plans and 56% in their LTI plans. While the market is mature in terms of ESG metrics, we observe companies refining their approaches by shifting from generic to company-specific metrics and implementing more rigorous and robust target setting.

Looking ahead, we anticipate a trend towards greater customization and flexibility in compensation approaches. To remain competitive and attract top talent, companies are increasingly moving away from the "one-size-fits-all" approach. We are seeing a rise in the use of multiple benchmark peer groups (both local and international) and a more flexible policy language that allows for regional differentiation where necessary and reasonable.

How globalization is affecting the environment surrounding executive pay and how companies are adapting to compete

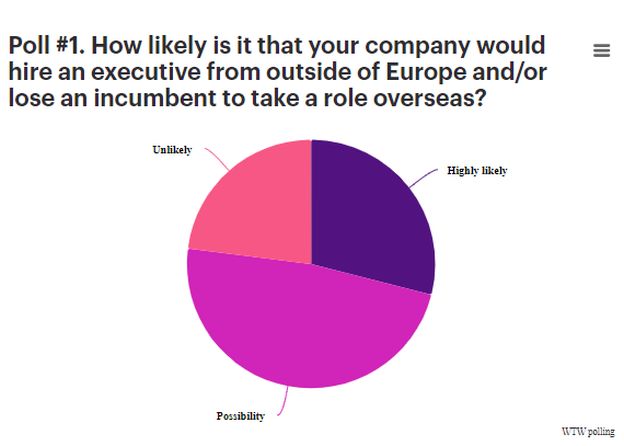

Throughout Europe, it is evident that companies are encountering challenges in attracting, motivating, and retaining talent. We asked the webcast participants how likely it is that their company would hire an executive from outside Europe and / or lose an incumbent to take a role overseas.

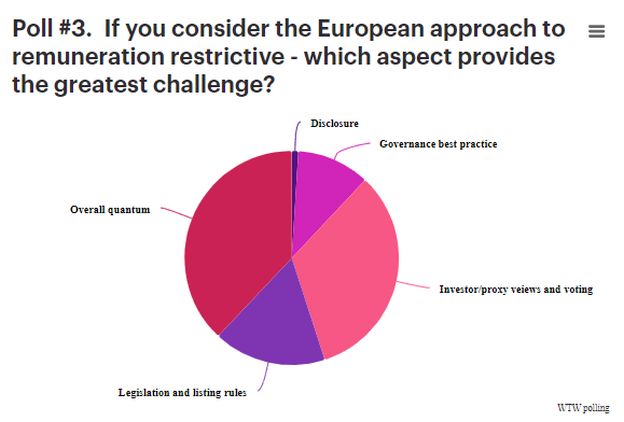

The results indicate that the executive talent market is truly global. In addition, 60% of webcast participants consider Europe's approach to remuneration very restrictive when recruiting executive talent from outside Europe. In terms of the greatest challenges, 38% see them in the area of overall quantum, whereas 33% see them in the form of investor and proxy views.

As a result, European companies are becoming increasingly innovative in their approaches to address the widening gap in pay levels between the US and Europe. While some may attribute this difference in pay levels primarily to larger company sizes in the US, our analysis reveals that even when companies are comparable in size, US target pay levels significantly surpass those in Europe. Most of the difference is attributed to significantly higher equity grant practices in the US and, consequently, a greater risk associated with the overall compensation package. However, is this assertion accurate?

The risk is somewhat mitigated in the US: a significant majority of US companies have adopted a portfolio approach, wherein Long-Term Incentive (LTI) grants typically comprise a blend of performance shares, restricted shares, and stock options. Furthermore, the underlying design parameters differ considerably compared to the European market. In the US, it is customary for time-vested equity, constituting approximately 50% of the equity mix, to commence vesting on the first anniversary of the grant date. Conversely, in Europe, 100% of the equity award is typically tied to performance targets, with the earliest vesting occurring after three years. Many of these US practices would be considered unacceptable in Europe. Nevertheless, the levels of shareholder support in each geography are comparable based on 2023 AGM results.

In summary, the combination of elevated pay levels in the US and substantial variation in equity plan design contribute to a lower perceived value of executive pay packages in Europe. Moreover, there currently appears to be limited leeway in the eyes of investors to expand the boundaries of compensation levels in Europe to compete with global sector peers or to introduce more flexible LTI vehicle mixes.

While 63% of our webcast participant stated that they would continue to navigate within the European approach, 32% would accept the potential voting implications of a more tailored approach or an increase in quantum and 5% would even consider a listing outside Europe. We think there are three broad approaches which might start to change established European norms:

01

European compensation design BUT increased quantum to align closer to the US.

02

Differentiating compensation design based on location of executive

03

Moving towards a compensation design AND increased quantum to align closer to the US.

24% of our webcast participants would most likely follow approach 1, i.e. keep typical European compensation design, but with increased quantum; 23% would most likely differentiate the compensation design depending on the location of the executive; and 53% would move towards a hybrid compensation design as well as increased quantum. So, we will perhaps experience some interesting AGM seasons in the coming years as we see companies tackling this issue and presenting proposals to shareholders.

What are the views of investors and proxy advisors on senior executive remuneration

Reviewing the outcomes of the AGM season in 2023, several key factors contribute to low votes on executive compensation packages. Issues that can on their own lead to a low vote include insufficient explanation for significant one-time awards, remuneration packages viewed as excessive by investors, and adjustments to actual performance outcomes. Additionally, combinations of factors such as insufficient disclosure, particularly concerning KPIs, their weightings and target achievement levels, base salary increases lacking proper justification, misalignment between payouts and financial performance, and limited responsiveness to investor concerns from previous years, are commonly observed as correlates to low voting outcomes.

It is important to note that investor preferences vary widely. Therefore, companies must seek to understand the specific expectations and guidelines of individual investors as they approach the AGM season. For deeper insights into investor expectations for 2024, please also consult our recent Executive Pay Memo: What are investors thinking about ahead of the 2024 AGM season?, which details our investor outreach exercise. During our webcast, we had the privilege of discussing expectations for the AGM season 2024 and key focus areas with Silvia Gatti from Glass Lewis. In overview, Glass Lewis's red lines and focal points are as follows:

- Red lines include:

-

- Poor disclosure of metrics and their weightings.

- Significant decreases in the risk profile of incentive plans not being accompanied by a proportional decrease in opportunity or significant increases in opportunity without justification.

- Pay for performance disconnects resulting from discretionary or one-time awards.

- Particularly significant, given the macroeconomic and geopolitical challenges, are events that should have impacted incentive payouts but did not based on the formulaic outcome. Any use of discretion in these cases needs to be carefully evaluated and disclosed.

- Glass Lewis recognizes differences in local practices. For instance, while the alignment of base salary increases with those of the workforce and disclosure of CEO pay ratio are common market practices in the UK, they are just beginning to spread across the rest of Europe.

- Regarding the Atlantic pay gap, Glass Lewis doesn't inherently oppose including US peers for benchmarking purposes if accompanied by comprehensive and proactive disclosure on peer group composition and the process used to determine this. However, local peers should not be disregarded in peer groups entirely.

- In countries like Germany, where management board members have multi-year contracts, new policies addressing previous shareholder concerns may be approved but only implemented upon contract renewal or new board member appointments. Glass Lewis expects disclosure around the rationale in such cases.

- Glass Lewis will have serious concerns where it appears that high overall payout levels have been achieved by means of outperformance against some metrics compensating for clear underperformance against others.

- Companies planning to increase base salary levels should communicate proactively and consider implementing these changes in the remuneration policy promptly.

Are Non-Executive Directors getting their 'fair share'?

Attracting and retaining top talent in an era of increasing complexity and time commitment is crucial in respect of Non-Executive Directors (NEDs). To gain insight into the current state of NED remuneration and emerging trends, WTW and ecoDa have collaborated to survey 278 Directors across Europe.

In line with our consulting experience, there is widespread consensus (92%) that the complexity and time commitment of Board roles have surged in recent years. However, despite this, 81% of directors feel that they are no longer adequately compensated for their roles. In determining appropriate fee levels, directors prioritize external benchmarking, time commitment, company size, and required expertise. They also advocate for regular fee reviews, with 45% favouring yearly reviews and 26% preferring biennial reviews.

Once an appropriate fee level is established, directors emphasize the importance of better aligning compensation with the time commitment and responsibilities of various NED roles. However, they oppose individualized fee variations based on specific skills or industry expertise, with only 35% in favour of this approach. Instead, differences in pay should primarily reflect factors such as travel time for overseas NEDs and varying time commitments for different board or committee responsibilities.

Based on the results, what is needed to make NED remuneration future-ready? If you are interested in the detailed survey results, please refer to the following whitepaper: Non-executive directors remuneration in Europe.

We are looking forward to our next European webcast and further interesting insights to be shared and discussed!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.