In part three of our four-part series on Reductions in Force in Asia Pacific, we looked at severance costs and benefits, key timing challenges, and consultation with employees or employee representatives.

In this final installment of our series, we'll cover the last three things that we recommend multinational employers consider: (#8) consideration of expats, (#9) post-employment considerations, and (#10) risks.

#8 – Consideration of Expats

When the RIF involves expat employees, four areas that companies might need to take into account include:

- Specific selection criteria. First, check whether there are any specific selection criteria that apply to foreign employees. There may be legal requirements in place requiring companies to select foreign employees before local employees, in particular for the jurisdictions that are more pro-employee and protective of their national core. For example, in Malaysia, within the same category of workers, foreign employees must be retrenched before local employees.

- Impact on employee composition. Employers should also consider whether and, if so, how the RIF would affect the foreign to local employee ratio. Even where a jurisdiction does not require companies to select foreign employees before local employees in a RIF, a legal requirement to maintain a certain foreign to local employee ratio may mean that companies will need to review the number of foreign and local employees who will be affected by the RIF to ensure that the foreign to local employee ratio will be maintained post-RIF. Singapore is an example of where such a ratio is in place.

In some jurisdictions (e.g., Vietnam), companies can only recruit expats for positions that require specific skills that cannot be found locally. Companies may therefore want to consider whether they can move expats to alternative roles that will require the expat's skillset.

Companies should also consider whether any workplace arrangements need to be reviewed in relation to expats. For example, in Indonesia, employers are required to appoint a local employee to be the companion of every expat, so that they can exchange views on technology and expertise. If a local companion will be terminated due to a RIF, the employer will need to appoint someone else to be the expat's local companion.

Work visa issues. Where an expat is working under an employment visa (or equivalent), sponsored or supported by the company, the company will need to consider the impact of the RIF on the expat and also what the company's obligations are to the immigration authorities and to the expat, if the expat is made redundant/retrenched. For example, will the work visa and the expat's right to remain in the jurisdiction lapse on shortly after the termination of employment, or will the employee be able to remain in the jurisdiction for a period of time to try and find another role?

If an expat's employment visa will lapse due to the RIF exercise, consider whether there is any obligation on the employer to repatriate the expat to his/her home country, under contract and/or statute. Even if there is no legal obligation to do so, companies can consider whether to offer a repatriation package as part of the RIF, perhaps in exchange for the employee entering into a mutual separation agreement where he/she agrees to waive and release the company from any claims.

- Notification obligations. Where the employee is on a work visa, companies would usually need to notify the relevant authorities (e.g., the immigration and inland revenue/tax departments) when the employment is terminated. There is often a prescribed timeframe on when the notification should be made.

In some cases, approval of an authority may be required in relation to an expat being made redundant and changing job. For example, in Indonesia, pre-approval from the Director General of Labor must be sought where a foreign employee intends to change employer, and the approval will only be granted in specific circumstances.

#9 – Post-employment Considerations

There are several post-employment issues that companies should be aware of:

- Taxation. Employers may be obliged to notify tax authorities of the termination of employment, within the prescribed timing. In some jurisdictions, the notification needs to be made prior to the termination of employment.

There is also the question of whether statutory severance is taxable as income – different jurisdictions take different approaches to this. Also, tax authorities may have varying views as to whether enhanced severance payments are taxable. These tax queries should be investigated prior to making any severance payments, together with whether the employer is subject to any tax-related withholding obligations in respect of termination/severance payments. For example, there are tax-related withholding obligations in Hong Kong.

- Data retention. We have been seeing governments in APAC jurisdictions placing greater emphasis on data privacy and protection in recent years. In terms of employee data, employers should find out whether there are data retention requirements under local laws, as well as what the best practices or guidelines in the market are. A breach of data privacy laws (inadvertent or otherwise) may lead to both civil and criminal consequences.

- Pensions. There may be notification requirements in relation to pensions – employers should check if they need to inform the relevant pensions provider, or central authority, of the termination of employees. Employers should also consider whether there are requirements – statutory or contractual – for them to assist with or procure any transfer or withdrawal of the pension funds. If so, the employer should prepare the necessary paperwork (noting whether there are prescribed timings for doing so) and liaise with the employees/relevant providers in relation to this.

- Restrictive covenants. It is common for employment contracts to provide for post-termination restrictive covenants, for example non-compete and non-solicitation of employees and customers. When looking at restraints, there are two main things to consider in a RIF situation – (i) whether the restraints are enforceable in the jurisdiction, and (ii) if so, whether the employer intends to enforce them.

As regards enforceability, local law advice is recommended, as legal frameworks can be vastly different – for example, in Malaysia, non-competes are prohibited; in the PRC, they are allowed but must be compensated for; in Australia and Hong Kong, restraints can be enforceable but must be drafted very carefully.

Even if the restraints are enforceable, employers may choose not to enforce them. For example, if an employee has been on garden leave prior to the termination, and therefore has been out of the market for a period of time, it may no longer be necessary to enforce the restraints. Offering to waive a non-compete could also be deemed valid consideration for an employee to enter into a waiver and release of claims.

- Confidentiality. Employees will generally be bound by confidentiality obligations post-termination of employment. However, employers often choose to remind employees of their confidentiality obligations or, depending on the roles/seniority of the employees involved, have them enter into fresh confidentiality undertakings on termination.

- Outplacement services. Employers may wish to consider whether to offer outplacement services to employees, to assist them to move on to another job or career. This may form part of the separation package in the case of a mutual termination, or may be offered more generally as part of the standard RIF exercise. Outplacement services are not as common in Asia Pacific as they are in other parts of the world, but they can be a helpful benefit to offer employees in a RIF situation to make the job-hunting process easier for them.

- Debriefing. After the RIF, it is advisable to debrief and review the lessons learned – are there matters for improvement, or special points that should be noted? Are there particular cultural factors, legal requirements, etc., that the employer should bear in mind for if there is a next time? Consolidating this information, as well as keeping good records of all relevant paperwork and communications, can be of substantial value for any future RIFs.

- Employee relations. Last but not least, employers should manage employee relations of the remaining team carefully during and after a RIF exercise. RIFs can affect existing employees in numerous ways – their job duties and compensation may change due to the RIF; there may be feelings of negativity or insecurity, etc. It is important for employers to provide adequate support and reassurance to the remaining employees in order for the workplace to remain positive and productive. For example, employers can arrange for employees to access employee assistance programs, encourage and foster open communications between managers and employees, communicate a positive outlook and company values to the employees, and provide reassurance – if possible – that there are no further planned RIFs for the time being.

#10 – Risks

There are significant risks and consequences if a unilateral termination for a RIF is regarded as a wrongful dismissal (noting this phrase may have different meanings in different jurisdictions).

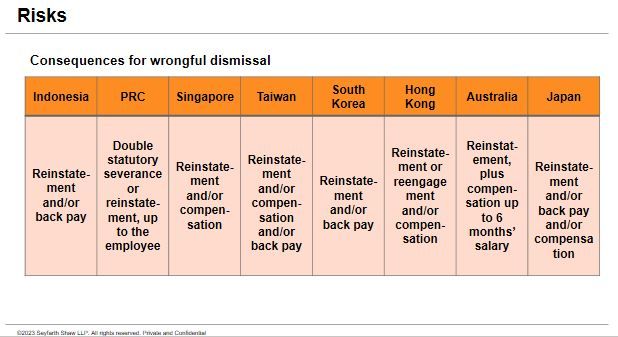

Figure 1 presents the consequences for wrongful dismissal in various jurisdictions. Reinstatement is the most widely recognized consequence, and compensation is generally an alternative or combined consequence. The provisions regarding wrongful dismissals in the PRC are more detailed and worthy of close attention.

The key takeaways related to the risks of a wrongful dismissal are four-fold:

- Before the RIF, determine the ultimate goal and work backwards from there. This requires a thorough analysis of the entire business and employment situation.

- Ask yourself: "What's the priority?" and "Which is more important – maintaining good employee relations, speed, or minimizing overall cost?" By answering these questions, you will be clear and can focus on the company's priorities and needs.

- Try to get the full picture from local HR and headquarters to understand the current employment and RIF situation in the intended jurisdictions.

- Finally, bear in mind that it's fairly typical to face litigation risks and industrial disruption in a large RIF exercise. Therefore, it's important to be aware of this and fully prepared regarding the process.

We hope that our series breaking down the top ten things to look out for in APAC reductions in force has been insightful. Our authors would be pleased to address any follow-up queries you may have.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.